Vancouver Housing Market Update: November 2025 Analysis

Introduction

Are you wondering whether now is the right time to buy a home in Vancouver? With the Bank of Canada cutting interest rates four times in 2025 and home prices continuing to adjust, November 2025 presents a unique opportunity for Vancouver homebuyers who have been waiting on the sidelines.

The Greater Vancouver real estate market has shifted dramatically from the seller-dominated conditions of previous years. Today's market offers buyers more negotiating power, increased inventory, and mortgage rates at their lowest levels in over three years. However, navigating these conditions requires understanding the current data and knowing how to leverage market dynamics in your favour.

In this comprehensive analysis, I'll break down the latest Vancouver housing statistics, explain what current mortgage rates mean for your purchasing power, and provide actionable strategies whether you're a first-time buyer, upgrading homeowner, or real estate investor. By the end, you'll have the insights needed to make confident decisions in Vancouver's November 2025 housing market.

Table of Contents

October 2025 Market Statistics: The Numbers You Need to Know

Property Type Breakdown: Detached Homes, Townhouses & Condos

Listen to our Podcast: Vancouver Housing Buyer Opportunity November 2025

October 2025 Market Statistics: The Numbers You Need to Know

The latest data from Greater Vancouver Realtors (GVR) paints a clear picture of current market conditions. Understanding these statistics is essential for anyone considering a Vancouver home purchase.

Sales Activity and Market Balance

Metro Vancouver recorded 2,255 residential sales in October 2025, representing a 14.3% decrease compared to October 2024. This figure also fell 14.5% below the 10-year seasonal average of 2,638 sales. While this might sound concerning, it actually signals favourable conditions for buyers who are ready to act.

The sales-to-active listings ratio—a key indicator of market balance—sits at 14.2% across all property types. When this ratio falls below 12% for a sustained period, we typically see downward pressure on prices. When it exceeds 20%, prices tend to rise. The current balanced-to-buyer's market conditions mean you have room to negotiate.

Inventory Levels Creating Opportunity

Active listings reached 16,393 properties at the end of October, up 13.2% from the same time last year. This inventory level sits 35.9% above the 10-year seasonal average of 12,063 listings. For buyers, more choice means less competition and greater leverage during negotiations.

New listings remained stable with 5,438 properties hitting the market in October, essentially flat compared to last year. This steady supply continues to give buyers options across virtually every neighbourhood and property type in Metro Vancouver.

Benchmark Pricing Trends

The composite benchmark price for all Metro Vancouver residential properties reached $1,132,500 in October 2025. This represents a 3.4% decrease year-over-year and sits approximately 10% below the all-time high of $1,259,900 set in April 2022.

For context, Vancouver's benchmark home price has increased roughly 40% over the past decade, but the recent correction has created entry points that haven't existed for years. The average home price came in at $1,265,670, showing a modest 1.2% annual increase.

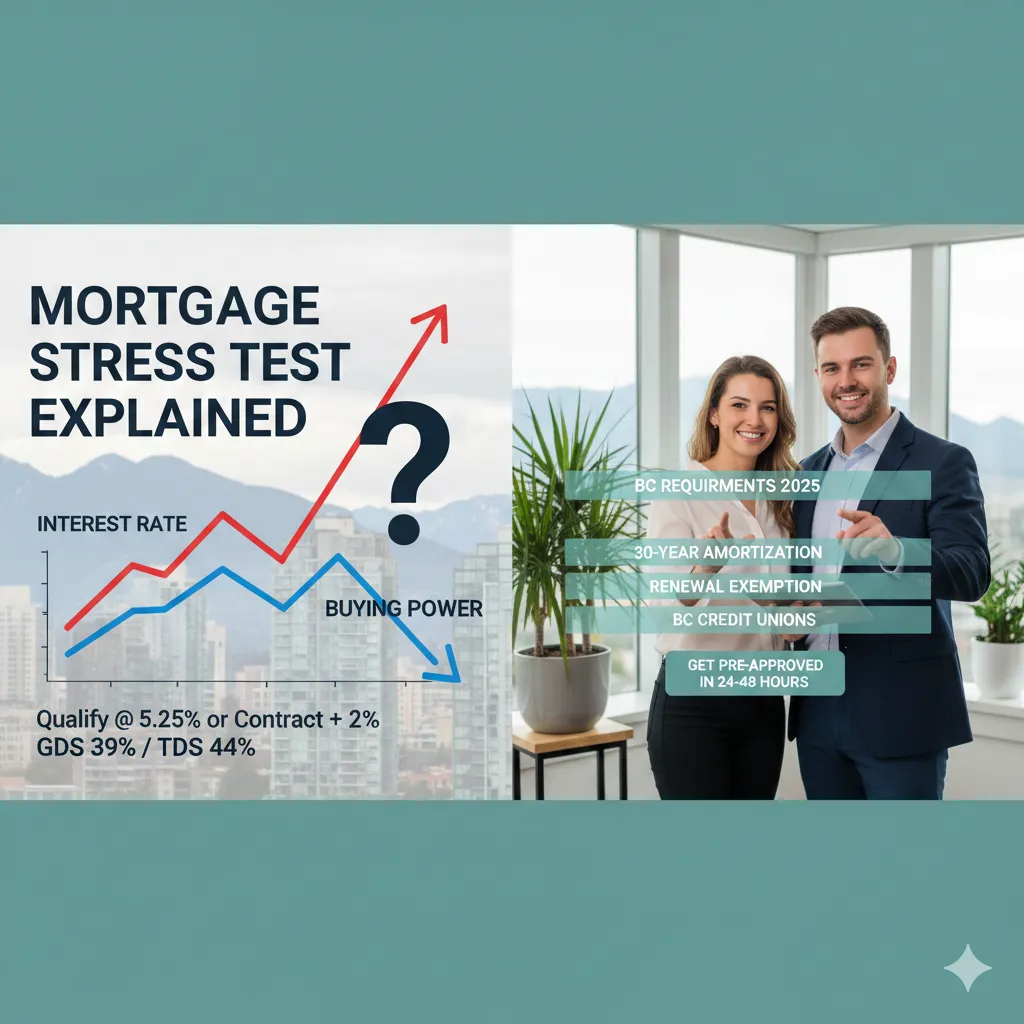

Vancouver Mortgage Rates: What Buyers Are Paying Today {#vancouver-mortgage-rates}

Mortgage rates have become significantly more favourable in 2025, fundamentally changing the affordability equation for Vancouver homebuyers.

Bank of Canada Policy Rate Impact

The Bank of Canada implemented its fourth rate cut of 2025 in October, bringing the policy rate down to 2.25%. This represents a dramatic 2.75% reduction from the peak of 5% reached in 2023-2024. For variable-rate mortgage holders and new buyers, this translates directly into lower monthly payments.

The next Bank of Canada announcement is scheduled for December 10, 2025. Current market expectations suggest rates will likely hold steady, as the Bank has indicated the policy rate is now at the lower end of its neutral range of 2.25% to 3.25%.

Current Mortgage Rate Landscape

Today's mortgage rates offer substantial savings compared to 2023 and 2024. The best available five-year fixed rates hover around 3.79% for high-ratio mortgages (down payment under 20%), while five-year variable rates have dropped to approximately 3.45%—the lowest levels in over three years.

For a practical example, consider a $900,000 Vancouver home purchase with a 10% down payment ($90,000). At today's rates around 3.79%, your monthly mortgage payment on the $810,000 mortgage would be approximately $4,175 with a 25-year amortization. Compare this to rates above 6% in late 2023, where the same mortgage would have cost over $5,500 monthly.

Fixed vs. Variable Rate Considerations

The current rate environment presents an interesting decision point for Vancouver buyers. Variable rates offer immediate savings and have room for further decreases if economic conditions weaken. However, fixed rates provide payment certainty and protection against potential future increases.

Most mortgage forecasters expect five-year fixed rates to remain relatively stable through early 2026, potentially dipping slightly before trending modestly higher in 2027. Variable rates depend largely on Bank of Canada decisions, with limited further cuts expected unless economic conditions deteriorate significantly.

Need help determining which mortgage option suits your situation? Schedule a free consultation to discuss your options.

Property Type Breakdown: Detached Homes, Townhouses & Condos {#property-type-breakdown}

Each property type in Metro Vancouver tells a different story in November 2025. Understanding these distinctions helps you identify where the best opportunities exist for your specific situation.

Detached Single-Family Homes

Detached homes saw 693 sales in October 2025, a 4.3% decrease from the previous year. The sales-to-active listings ratio of 11.3% for detached properties indicates a buyer's market in this segment.

The benchmark price for detached homes reached $1,916,400, representing a 4.3% year-over-year decrease and 0.9% monthly decline. The average sale price came in at $2,096,078, which actually represents a modest 1.6% annual increase—suggesting some movement in the luxury segment while overall benchmark prices adjust.

For detached home buyers, the current market offers more negotiating room than we've seen in years. Properties are sitting longer, and sellers are increasingly receptive to offers below asking price.

Townhouses and Attached Homes

The townhouse segment recorded 477 sales in October, down 4.8% from October 2024. The benchmark townhouse price sits at $1,066,700, representing a 3.8% annual decrease and 0.3% monthly decline.

With a sales-to-active listings ratio of 17.6%, townhouses remain the most balanced segment of the market. This property type continues attracting families seeking more space than condos offer while remaining below detached home prices.

The average price for attached homes came in at $1,183,985, down 8% year-over-year and 2.8% from September. This steeper average price decline suggests motivated sellers and negotiation opportunities in specific segments.

Condominiums and Apartments

The condo market has experienced the most significant adjustment. October saw 1,071 apartment sales, a substantial 23.1% decrease from October 2024. The benchmark condo price reached $718,900, down 5.1% year-over-year and 1.4% from September.

Condos represent an increasingly attractive entry point for first-time buyers and investors. With rental vacancy rates increasing and asking rents declining approximately 8% year-over-year, investor sentiment has cooled. However, for end-users planning to live in their purchase, current condo prices offer relative affordability compared to historical peaks.

The sales-to-active listings ratio of 15.5% for apartments indicates modest buyer's market conditions, giving purchasers leverage in negotiations.

First-Time Buyer Programs & Incentives for 2025 {#first-time-buyer-programs}

First-time buyers in Vancouver have access to numerous provincial and federal programs designed to make homeownership more achievable. Taking advantage of these incentives can save you tens of thousands of dollars.

BC First-Time Home Buyers' Program

British Columbia offers a Property Transfer Tax exemption that can save qualifying first-time buyers up to $8,000. Properties with a fair market value under $500,000 receive a full exemption, while partial exemptions apply for homes valued between $500,000 and $835,000.

To qualify, you must have lived in BC for at least one year before your purchase and never owned a registered interest in any property that served as your principal residence anywhere in the world.

Federal First Home Savings Account (FHSA)

The Tax-Free First Home Savings Account allows qualifying buyers to contribute up to $8,000 annually, with a lifetime maximum of $40,000. Contributions are tax-deductible like RRSPs, while withdrawals for a qualifying home purchase are completely tax-free like TFSAs.

This powerful savings vehicle combines the best features of both registered account types, making it an essential tool for anyone planning to purchase their first home.

Home Buyers' Plan (HBP)

The Home Buyers' Plan allows first-time buyers to withdraw up to $60,000 from their RRSPs tax-free for a down payment. Couples can combine withdrawals for up to $120,000 total. This can be used alongside the FHSA for maximum down payment accumulation.

The withdrawal must be repaid to your RRSP over 15 years, beginning five years after the withdrawal.

30-Year Amortization for First-Time Buyers

As of December 15, 2024, first-time buyers and purchasers of new construction can access 30-year amortization periods on insured mortgages. This reduces monthly payments compared to the traditional 25-year amortization, improving affordability for qualifying buyers.

Additional Tax Credits and Rebates

The First-Time Home Buyers' Tax Credit (HBTC) provides a non-refundable tax credit of up to $1,500 to help offset closing costs. Simply claim $10,000 on line 31270 of your tax return for the year you purchase your qualifying home.

New construction buyers may also qualify for GST rebates of up to $6,300 on homes priced under $450,000, with partial rebates available up to $450,000.

Ready to explore your first-time buyer options? Get pre-approved in 24-48 hours and discover exactly how much home you can afford.

What This Means for Vancouver Homebuyers {#what-this-means-for-buyers}

The convergence of lower interest rates, increased inventory, and softening prices creates conditions that favour prepared buyers. Here's how to position yourself for success in this market.

Buyer Strategies for November 2025

The current balanced-to-buyer's market means you should approach negotiations with confidence. Properties are often selling at or slightly below assessed value, and motivated sellers are receptive to reasonable offers. Don't be afraid to negotiate—this is one of the most buyer-friendly environments Vancouver has seen in years.

Get pre-approved before you start seriously looking at properties. A pre-approval letter demonstrates to sellers that you're a serious, qualified buyer. It also locks in your interest rate for 60 to 130 days depending on the lender, protecting you from potential rate increases.

Timing Considerations

While trying to perfectly time the market is impossible, current conditions suggest no urgency to wait for further price declines. With the Bank of Canada indicating rates are near the bottom of their expected range, the interest rate tailwind that has driven recent market softening may be diminishing.

Royal LePage forecasts modest 4% price increases for Greater Vancouver in 2025, suggesting the bottom may be forming. Buyers who act now can secure current pricing while enjoying favourable borrowing rates.

Working With a Mortgage Professional

Navigating today's mortgage landscape requires expertise. With multiple lenders offering varying rates, terms, and qualification criteria, working with a mortgage broker ensures you access the most competitive options for your specific situation.

Self-employed borrowers, newcomers to Canada, and those with complex income situations particularly benefit from broker relationships. We work with numerous lenders and can match your profile to the best available products.

FAQs

Is now a good time to buy a home in Vancouver?

November 2025 offers favourable conditions for prepared buyers. With mortgage rates at three-year lows, inventory 36% above seasonal averages, and prices 10% below 2022 peaks, qualified buyers have negotiating leverage and access to more choice than in recent years. The key is ensuring you're financially prepared with a mortgage pre-approval before making offers.

What is the average home price in Vancouver in November 2025?

The Metro Vancouver composite benchmark price is $1,132,500 as of October 2025, down 3.4% year-over-year. The average sale price is $1,265,670. By property type, detached homes average $2,096,078, townhouses $1,183,985, and condos $765,119. Prices vary significantly by neighbourhood and property condition.

What mortgage rate can I get in Vancouver right now?

As of late November 2025, the best five-year fixed mortgage rates are approximately 3.79% for high-ratio mortgages, while five-year variable rates are around 3.45%. Your actual rate depends on factors including down payment size, credit score, income verification, and the specific lender. Getting pre-approved reveals your personalized rate options.

How long does mortgage pre-approval take?

With the right documentation ready, mortgage pre-approval can be completed in 24 to 48 hours. You'll need recent pay stubs, tax documents (T4s or returns), proof of down payment funds, employment verification, and government ID. The pre-approval letter typically remains valid for 60 to 130 days depending on the lender.

What programs help first-time buyers in Vancouver?

First-time buyers in BC can access the Property Transfer Tax exemption (up to $8,000 savings), the federal First Home Savings Account ($40,000 tax-free savings), the Home Buyers' Plan ($60,000 RRSP withdrawal), the First-Time Home Buyers' Tax Credit ($1,500), and 30-year amortization options. Combining these programs can save tens of thousands of dollars.

Conclusion

Vancouver's November 2025 housing market presents genuine opportunity for informed buyers. With mortgage rates at three-year lows following four Bank of Canada rate cuts, inventory significantly above historical averages, and prices adjusted from 2022 peaks, the fundamentals have shifted in buyers' favour.

The data is clear: sales-to-active listings ratios indicate balanced-to-buyer's market conditions across all property types. Whether you're targeting a detached home, townhouse, or condo, you'll find more selection and negotiating room than at any point in recent memory.

However, opportunity without action remains just that—an opportunity. The most successful buyers in this market are those who position themselves with mortgage pre-approval, understand their purchasing power, and act decisively when the right property appears.

The combination of current pricing, favourable rates, and available inventory won't last indefinitely. As the Bank of Canada indicates rates have reached the lower end of their expected range, the interest rate catalyst for market softening may be diminishing. Buyers who act now secure today's conditions.

Ready to take the next step in Vancouver's housing market? Your personalized mortgage strategy starts with a conversation. Whether you're a first-time buyer exploring your options, a homeowner looking to upgrade, or an investor analyzing opportunities, I'm here to help you navigate this market with confidence.

Call Bill Karalash at 604-265-5858 or schedule your free consultation to get pre-approved in 24-48 hours and discover exactly what you can afford in today's Vancouver market.

About the Author

Bill Karalash is a licensed Sub-Mortgage Broker (BC License MB610235) operating under Breezeful Mortgage Brokerage (BC License MB601942). Specializing in Vancouver and Lower Mainland mortgages, Bill provides personalized solutions for first-time buyers, self-employed borrowers, newcomers to Canada, and complex financing situations. Learn more at billkaralash.ca.

Sources

Greater Vancouver Realtors (GVR) – October 2025 Statistics Report (creastats.crea.ca)

WOWA.ca – Vancouver Housing Market November 2025 Update (wowa.ca)

Bank of Canada – Policy Interest Rate (bankofcanada.ca)

Ratehub.ca – Best Mortgage Rates Canada November 2025 (ratehub.ca)

Province of British Columbia – First Time Home Buyers' Program (gov.bc.ca)