Mortgage Stress Test Explained: BC Requirements for 2025

Introduction

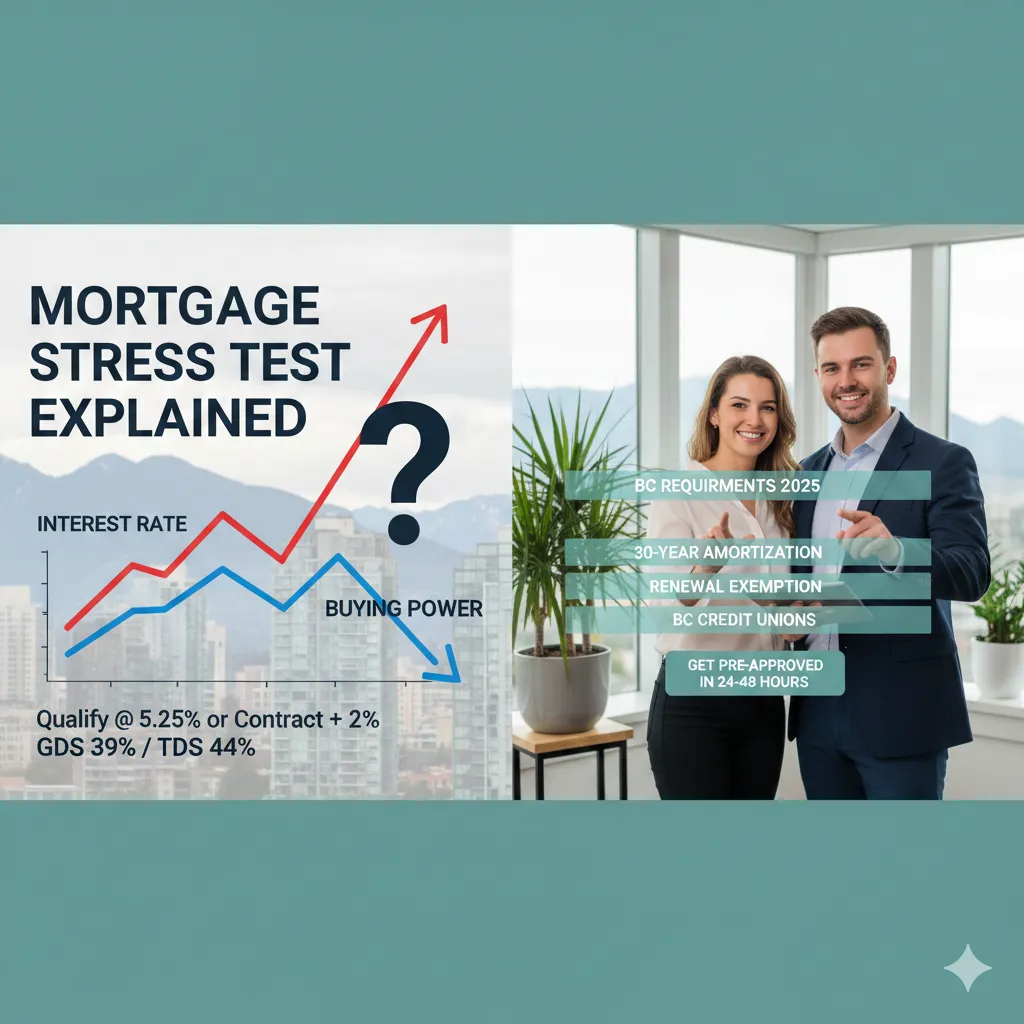

Struggling to qualify for a Vancouver mortgage despite a good income? You're not alone—the mortgage stress test reduces your borrowing power by 15-20%, and with Metro Vancouver's average home price sitting at $1,132,500, that's a difference of up to $170,000 in purchasing power.

The mortgage stress test requires BC homebuyers to qualify at the higher of 5.25% or your contract rate plus 2%, with a maximum gross debt service (GDS) ratio of 39% and total debt service (TDS) ratio of 44%. These rules apply to virtually all mortgages from federally regulated lenders.

In this guide, you'll learn exactly how the stress test works in BC, the current 2025 qualifying rates, proven strategies to pass, and legitimate exemptions that could help you buy sooner. Whether you're a first-time buyer in Burnaby or refinancing in Richmond, understanding these rules is essential to achieving your homeownership goals.

Ready to see what you qualify for? Get pre-approved in 24-48 hours

Table of Contents

What Is the Mortgage Stress Test?

The mortgage stress test is a federal qualification requirement that determines whether you can afford your mortgage payments—not at today's rates, but at a significantly higher rate. Think of it as a financial safety net designed to protect both you and the Canadian banking system.

Why Does the Stress Test Exist?

Canada's Office of the Superintendent of Financial Institutions (OSFI) introduced the stress test between 2016-2018 to prevent Canadians from taking on mortgages they could only afford under ideal conditions. When interest rates rose sharply between 2022-2024, borrowers who'd barely qualified at rock-bottom rates faced serious financial strain.

How the Calculation Works

When you apply for a mortgage, lenders calculate your affordability using the qualifying rate—the higher of:

5.25% (the Bank of Canada benchmark floor), OR

Your contract rate + 2%

Example: If you're offered a 4.5% fixed rate, you'd qualify at 6.5% (4.5% + 2%). If offered 3%, you'd qualify at 5.25% since that's higher than 5% (3% + 2%).

The Debt Ratio Requirements

Beyond the qualifying rate, lenders evaluate two critical ratios:

GDS Ratio (max 39%): Housing costs (mortgage, property taxes, heating, 50% of condo fees) as a percentage of gross income

TDS Ratio (max 44%): All debts (housing + car loans, credit cards, student loans) as a percentage of gross income

Impact on Vancouver buyers: With a $100,000 household income and minimal debt, you might qualify for approximately $445,000-$500,000 in mortgage financing under current stress test rules—potentially $80,000-$100,000 less than your actual payment affordability.

Check your borrowing power → Get a free pre-approval

Current BC Stress Test Requirements (December 2025)

Understanding the specific rules in effect right now is essential for anyone buying in Metro Vancouver or anywhere in BC.

The Qualifying Rate

As of December 2025, the Bank of Canada's benchmark qualifying rate remains at 5.25%—unchanged since June 2021. With most competitive fixed rates between 4-5%, most borrowers qualify at their contract rate plus 2%, meaning qualifying rates typically range from 6% to 7%.

Who Must Pass the Stress Test?

The stress test applies broadly:

All federally regulated lenders (Big Six banks, trust companies, federal credit unions)

Both insured and uninsured mortgages (regardless of down payment size)

New purchases, refinances, and lender switches (with recent exemptions—see below)

Major 2024-2025 Rule Changes

Several significant policy changes benefit BC buyers:

1. Renewal Switch Exemption (November 21, 2024) Borrowers renewing their mortgage can now switch to a new lender without another stress test, as long as the loan amount and amortization stay the same. This applies to both insured and uninsured mortgages.

2. 30-Year Amortization (December 15, 2024) All first-time homebuyers and all buyers of newly constructed homes can now access 30-year amortization periods on insured mortgages. This reduces monthly payments by approximately 8-10%, improving debt ratios.

3. Insured Mortgage Cap Increase (December 15, 2024) The price cap for insured mortgages increased from $1 million to $1.5 million, allowing buyers to purchase more expensive homes with as little as 5% down (plus 10% on amounts above $500,000).

Vancouver Market Reality Check

With Metro Vancouver's benchmark home price at $1,132,500 and detached homes averaging $1.9 million, many BC buyers face tough choices. Understanding how to maximize your qualification is critical.

Need help navigating these rules? Schedule a consultation

How to Pass the Stress Test in Vancouver's Market

Failing the stress test doesn't mean homeownership is impossible. Here are proven strategies to strengthen your qualification.

1. Improve Your Credit Score

Your credit score directly affects the interest rate you're offered. A lower rate means a lower stress test rate (when contract + 2% applies).

Quick wins:

Check your credit report for errors

Pay all bills on time

Keep credit utilization below 30%

Avoid new credit applications before your mortgage application

Target: 680+ for approval; 720+ for best rates

2. Increase Your Down Payment

A larger down payment reduces your required mortgage amount, improving your debt ratios.

BC buyer strategies:

First Home Savings Account (FHSA): Tax-free savings up to $8,000/year

Home Buyers' Plan (HBP): Withdraw up to $60,000 from RRSPs

Family gift: Down payment gifts from immediate family are accepted

Reaching 20% down also eliminates mortgage insurance and opens access to more flexible lender options.

3. Pay Down Existing Debt

Your TDS ratio includes all debt payments. Eliminating a $400/month car payment could increase your mortgage qualification by $60,000+.

Priority order:

Credit cards (high minimums relative to balance)

Car loans (fixed monthly payments)

Lines of credit

4. Use the 30-Year Amortization Option

If you're a first-time buyer or purchasing new construction, take advantage of the expanded 30-year amortization. This alone can improve your qualification by approximately 8-10%.

Pro tip: You can always make accelerated payments or lump sums later to pay off faster.

5. Work with a Mortgage Broker

A mortgage broker shops your application across dozens of lenders, finding the best combination of rate and qualification flexibility for your situation.

Different lenders have different appetites—what fails at one bank might succeed at another. A broker also understands how to structure applications for self-employed buyers, newcomers, and complex income situations.

Start your pre-approval with personalized guidance

Stress Test Exemptions and Alternatives for BC Buyers

Several legitimate pathways exist to work around or avoid the standard stress test requirements.

1. Mortgage Renewals (Same or Different Lender)

Same lender: No stress test required—simply renew your term.

Different lender (straight switch): As of November 2024, you can switch lenders at renewal without re-qualifying, as long as you don't increase your loan amount or extend your amortization.

2. BC Credit Unions

This is where BC buyers have a significant advantage. Credit unions in British Columbia are provincially regulated, not federally regulated, meaning they're not bound by OSFI's stress test rules.

How it works:

Many BC credit unions offer more flexible qualification at their contract rate

Best suited for borrowers with 20%+ down payment

Rates may be 0.25-0.50% higher than the most competitive bank rates

Trade-off: Slightly higher rate in exchange for higher qualification amount. For some buyers, this makes the difference between affording their ideal home or settling for less.

3. Private and Alternative Lenders

Private lenders and B-lenders aren't federally regulated and set their own qualification criteria, typically focusing on property equity rather than income.

Caution: Rates often exceed 8-10%. Use only as a short-term bridge while improving your situation for eventual refinancing with a traditional lender.

4. Exception Requests for Strong Borrowers

With 20%+ down, some banks make exceptions for strong applications featuring:

Excellent credit (740+)

Documented income growth potential

Significant remaining savings/investments after purchase

These aren't guaranteed, but a broker can help structure and present your case.

Want to explore your options? Book a consultation

FAQs

What is the current mortgage stress test rate in BC for 2025?

The stress test rate in BC is the higher of 5.25% or your contract rate plus 2%. Since most current mortgage rates are above 3.25%, most borrowers qualify at their contract rate plus 2%. For example, with a 4.5% mortgage rate, you'd qualify at 6.5%.

Can I avoid the mortgage stress test in British Columbia?

Yes, partially. BC credit unions are provincially regulated and may offer more flexible qualification criteria, especially with 20%+ down payment. Additionally, mortgage renewals (switching lenders without changing loan amount or amortization) are now exempt from stress testing as of November 2024.

How much less can I borrow because of the stress test?

The stress test typically reduces your maximum mortgage by 15-20% compared to qualifying at your actual contract rate. In Vancouver's market, that could mean $100,000-$150,000 less purchasing power.

Do I need to pass the stress test when renewing my mortgage?

No—if you're renewing with your current lender OR doing a straight switch to a new lender without increasing your loan amount or amortization, you're exempt from the stress test as of November 2024.

Will the mortgage stress test be eliminated in 2025?

OSFI is considering changes, potentially replacing the borrower-level stress test with portfolio-level risk limits for lenders. Changes could come late 2025 or early 2026, but nothing is confirmed. Plan based on current rules while staying informed.

Conclusion

The mortgage stress test is a significant hurdle for Vancouver and BC homebuyers, reducing borrowing power by 15-20% in one of Canada's most expensive markets. However, with strategic preparation—improving your credit, reducing debt, maximizing your down payment, and working with an experienced mortgage broker—most buyers find a pathway to qualification.

Key takeaways:

Qualify at 5.25% or contract rate + 2%, whichever is higher

Maintain GDS under 39% and TDS under 44%

Leverage new rules: 30-year amortization and renewal switch exemptions

Consider BC credit unions for more flexible qualification

The right strategy depends on your specific financial situation, timeline, and homeownership goals. As a licensed mortgage broker serving Vancouver and the Lower Mainland, I specialize in helping buyers navigate complex qualification scenarios—including self-employed income, newcomers to Canada, and borderline stress test situations.

Ready to find out what you qualify for?

📞 Call Bill Karalash: 604-265-5858 📅 Schedule Your Free Consultation 🏠 Get Pre-Approved in 24-48 Hours

Bill Karalash is a licensed Sub-Mortgage Broker (BC License MB610235) operating under Breezeful (BC License MB601942). This article is for informational purposes and does not constitute financial advice. Mortgage qualification depends on individual circumstances and lender requirements.